Use of alphabet shares in trading companies

Published in Taxation on 19th July 2022.

It is common for clients in the owner managed business sector to adopt some form of remuneration planning.

For some, it is a low salary/high dividend structure, others wish to provide management with shares to pay bonuses as dividends to make them more tax-efficient. But where should we draw the line on what is legitimate tax mitigation compared to tax avoidance?

Generally, potential shareholders can be split into three categories:

1) Spouses (or civil partners) of the working shareholder.

2) Persons connected to the working shareholder (eg children or other family members).

3) Unconnected employees.

The primary concern in each case is whether the settlements legislation or the employment-related securities (ERS) legislation will apply resulting in an increased tax charge.

Employment-related securities

For unconnected persons, the main area of concern is the ERS provisions contained within ITEPA 2003, Part 7 which seeks to impose an income tax charge on earnings.

As with most anti-avoidance legislation, it is widely drafted and ITEPA 2003, s 421B(1) states that the provisions ‘apply to securities, or an interest in securities, acquired by a person where the right or opportunity to acquire the securities or interest is available by reason of an employment of that person or any other person.’

Clearly, the issue of shares to an employee for remuneration planning purposes will be caught by this definition.

Generally, those gifting shares to spouses and connected persons can rely on the ‘personal relationships exemption’ at ITEPA 2003, s 421B(3). However, caution should always be taken here to ensure that there is no suggestion that, despite the personal relationship, the shares were actually issued by reason of employment. An example outlined in HMRC’s manual (ERSM20220) where this may apply is where the connected person is not the only employee receiving shares at that time.

Note that where a new issue of shares is to be made for the purpose of the gift, it is worth issuing them to the existing shareholder in the first instance, who will then gift the shares to the connected person. This is because, technically, the company itself does not have a personal relationship with the individual and therefore, the first requirement of s 421B(3) would not apply – ‘the person by whom the right or opportunity is made available is an individual’.

This is perhaps a technical point that, in practice, may not be pursued by HMRC in an enquiry and, if it were, there is an argument that the director is exercising his control over the company to issue shares to a person connected with them, but why create a potential issue when there need not be one?

Settlements legislation

Although spouses and connected persons are often outside the scope of ERS this does not mean remuneration planning cannot be attacked by HMRC under other provisions, such as the settlements provisions within ITTOIA 2005, Pt 5 Ch 5.

The settlements provisions prevent an individual (the settlor) from diverting income to another individual (the beneficiary) for the purpose of obtaining a tax advantage.

An important difference here is where the arrangements are caught by the settlements legislation, the payments continue to be treated as dividends but on a different individual (ie the higher rate taxpayer).

This contrasts with the ERS legislation which converts a dividend payment into earnings subject to PAYE and National Insurance.

This legislation only applies where the settlor retains some interest in the settled property or income. Whichever category of shareholder is relevant in each case, where dividends are to be paid at differing rates or amounts, there are two methods for achieving this:

1) Dividend waivers.

2) Alphabet shares.

Dividend waivers – what’s the issue?

Dividend waivers are relied upon where shareholders wish to pay dividends disproportionately to their shareholdings whilst holding the same class of shares as another shareholder.

The settlements provisions are key to understanding the risks associated with waivers and the legislation is very widely drawn.

ITTOIA 2005, s 620 defines ‘settlement’ as including ‘any disposition, trust, covenant, agreement, arrangement or transfer of assets’.

One of the key concepts of a settlement is that of ‘bounty’ whereby the beneficiary (in this case the shareholder receiving the dividend) obtains a benefit that they would not have received from an arms-length transaction.

In essence, for a dividend waiver to be successful in avoiding the settlements provisions, it must be ‘commercial’.

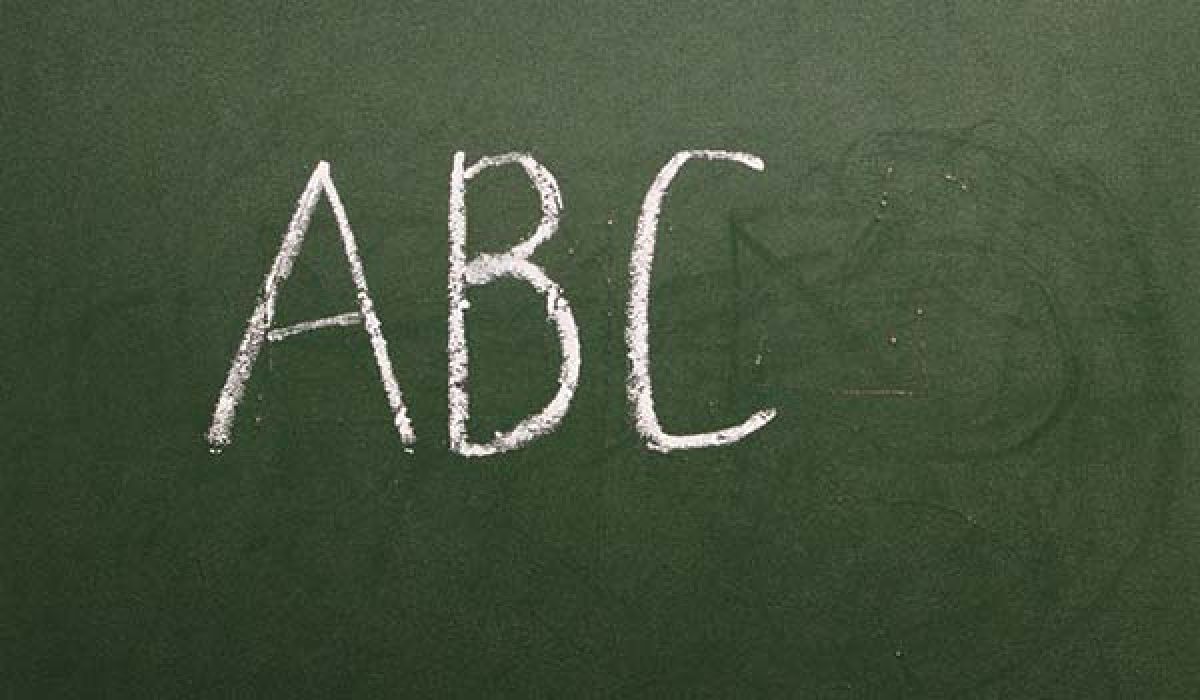

In its manual, TSEM4225, HMRC provides several circumstances in which it will consider the settlements legislation to apply in the case of dividend waivers:

- There are insufficient distributable reserves to pay the dividend at the same rate had the waiver not been made.

- Even if there are sufficient distributable reserves for each individual dividend including the amount waived to be made, a series of successive waivers (over several years) would have exceeded the accumulated distributable reserves.

- Any other evidence suggesting that the same rate would not have been paid on all the issued shares in the absence of the waiver.

- The non-waiving shareholders are persons whom the waiving shareholder can reasonably be regarded as wishing to benefit from the waiver.

- The non-waiving shareholder would pay less tax on the dividend than the waiving shareholder.

Where the settlements legislation is applied, it will result in the income becoming taxable on the settlor (in this case the waiving shareholder).

Spouse and connected persons

Clearly, in the case of connected persons, in particular, it is likely that at least one of the above points would apply, eg a simple case of 50:50 shareholdings between spouses where one spouse has a lower income would fail on both of the final two points even if reserves were not an issue, which they often are when considered over a number of years. See Example 1a.

A leading case on the subject of dividend waivers for shares held by spouses is Buck (2008) SpC 716. Here, Mr Buck held 9,999 shares and his wife owned 1 share and shortly before the year end Mr Buck waived his dividend entitlement and £39,371 and £27,774 dividends (representing a significant proportion of distributable reserves) were paid to Mrs Buck in the years ended 31 March 1999 and 31 March 2000 respectively. Such a significant disparity in shareholdings was always going to be a problem concerning the first two indicators above in relation to distributable reserves as well as the argument for commerciality. As a result, the courts held that the settlements legislation did apply and the dividend income became taxable on Mr Buck.

A further case considering dividend waivers between spouses was Donovan and another (TC3188). What is interesting about this case is that the lack of distributable reserves was not considered to be conclusive in and of itself, instead, the lack of commercial purpose was key to the FTT deciding in HMRC’s favour.

It is also worth noting that, within the settlements legislation at ITTOIA 2005, s 626, there is an exemption where there is an outright gift of property to a spouse. However, a dividend waiver is not an outright gift of property, it is merely a gift of a right to income. Therefore, the exemption cannot apply.

Unconnected persons

For companies with several unconnected shareholders, it is more unusual to find dividend waivers being used unless there is a genuine commercial reason.

However, the settlements provisions may still apply between unconnected persons provided there is an element of bounty and the settlor retains an interest in the property. In this case, the settlor and beneficiary acting together to reduce their tax burden would be sufficient to create a settlement.

Dividend waivers – summary

Given the risks associated with dividend waivers, whether in isolation or following a succession of waivers, the issues surrounding distributable reserves and whether a waiver may genuinely be considered to be commercial, caution should always be advised when adopting dividend waivers in practice.

Alphabet shares

Alphabet shares are shares of different classes, eg A ordinary, B ordinary, etc, that may have the same or similar rights as one another but enable the company flexibility in the amount of dividend paid on each class without some of the formalities of dividend waivers described above.

Spouse shares

It is always necessary to consider the ERS legislation in relation to shares held by a spouse or other connected person. However, provided the personal relationship exemption applies (at ITEPA 2003, s 421B(3)) when the shares are obtained, the future dividend payments remain outside the scope of the ERS legislation as well.

While there may not be an ERS problem, the settlements legislation may still apply to the payment of dividends in much the same way as for dividend waivers. Thus, the same questions must be considered; was there a gratuitous transfer or an element of bounty? Is the scenario commercial? Etc.

The best-known case relating to shares held by spouses – though not directly relating to alphabet shares – is the Arctic Systems case (Garnett v Jones [2007] STC 1536), finally decided in the House of Lords, the principles of which continue to apply to alphabet shares.

This involved Mr and Mrs Jones being 50:50 shareholders in a company whereby Mr Jones was responsible for generating the whole of the profits.

In that case, the court held that there was indeed an element of bounty to which the settlements legislation applied as Mr Jones would not have issued 50% of the equity of the company to a third party providing the paid services that Mrs Jones provided. Thus, the transaction was not at arm’s length.

However, the case hinged on whether the spousal exemption in ITTOIA 2005, s 626 applied. As we have seen in the case of dividend waivers, s 626 cannot apply where the gift is merely a right to income and HMRC lost the Arctic Systems case because the court held that the ordinary shares held by Mrs Jones provided a right to participate in a capital distribution on a winding up and a right to vote, not merely a right to income.

While in the Arctic Systems case Mr and Mrs Jones held the same class of shares, the principles of the decision may be extended to the use of alphabet shares in terms of the application of the settlements legislation. The implication being that most shares held by a spouse (whether the same class or different) should be OK provided they are not dividend only shares. Therefore, it is vital that the shares carry the normal rights to capital and/or voting, as well as income if the outright gifts exemption of s 626 is to be relied upon.

Extending this idea and considering a similar example to Buck above, if we assume Mr Buck had held 9,999 A ordinary shares and Mrs Buck held one B ordinary share and the A and B ordinary shares both held rights to income, voting and capital, would the outright gift exemption of s 626 continue to apply such that Mrs Buck would remain taxable on the dividends?

The concept of ‘thin’ shares should be considered in this case. Considering the conditions of s 626 in more detail, for the exemption to apply, there must be an outright gift:

- of property from which income arises;

- made by one spouse to the other (or one civil partner to the other); and

- meeting conditions A and B:

- Condition A is that the gift carries a right to the whole of the income.

- Condition B is that the property is not wholly or substantially a right to income.

Clearly, the above example would fail on condition B, ie Mrs Buck does hold ‘substantially a right to income’ on the basis that her single share represents only 0.01% of the capital and voting rights.

In conclusion, to ensure the settlements legislation does not apply, the share must not be ‘substantially a right to income’. This means the rights on those shares must include either capital or voting rights (or both) and the percentage of capital/voting rights held must not be incidental. See Example 1b.

Connected person shares

In the case of connected persons, where the ERS personal relationship exemption does apply, the spousal exemption at s 626 cannot be in point as this relates only to spouses and civil partners.

10/02/2023, 08:35 Use of alphabet shares in trading companies | Taxation https://www.taxation.co.uk/Mvc/Views/PrintPreview.html#Use of alphabet shares in trading companies 7/10

Note that ITTOIA 2005, s 629 prevents income arising as a result of gifts made by parents to their minor children from being effective in transferring income as the income will remain taxable on the parents. This applies only between parents and their minor children, eg grandparents gifting shares to their minor grandchildren would not be affected by s 629.

HMRC manual TSEM4200 specifically states that ‘it is not necessary for the settlor’s spouse, civil partner or children to be the people to whom the income is transferred’, thus connected persons are certainly within the scope of Chapter 5 and one could argue that there is greater scope for the provisions to apply due to the lack of protection from s 626.

In which case, the commerciality of the arrangement as well as whether there is an element of bounty will become important considerations in assessing whether there is a settlement and therefore any dividends paid on the separate class of shares should be taxable on the settlor.

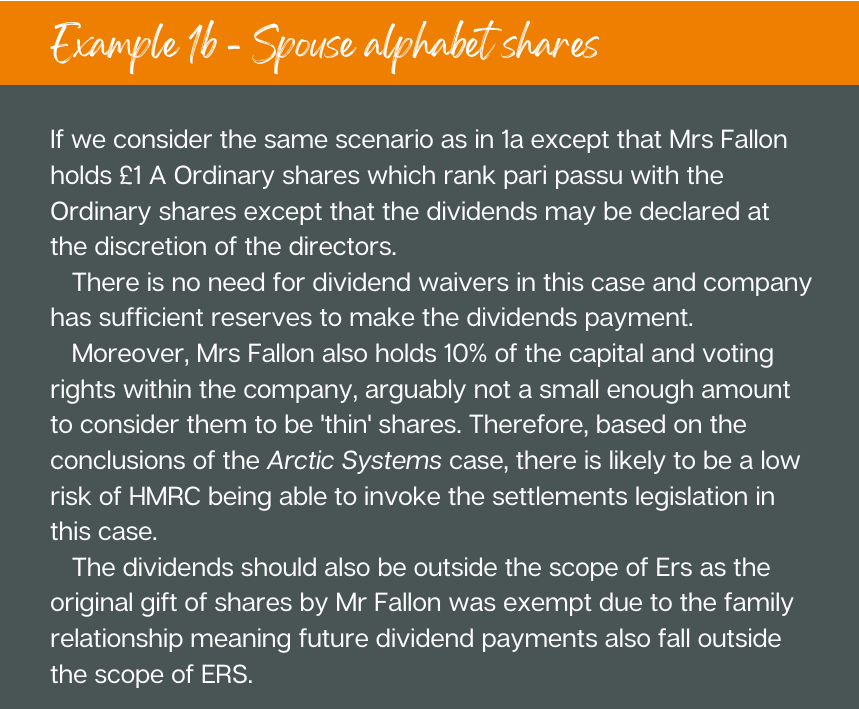

Employee shares

In the case of employees receiving shares, we are less concerned with the settlements provisions, partly because, as unconnected individuals, there is an overriding assumption that the transaction is at arm’s length and therefore there is no intention of gratuity, but also the ERS legislation in ITEPA 2003, Part 7 seeks to tax employees on the award of shares.

In terms of the award of shares to employees, there are two issues to be concerned with in the case of alphabet shares and remuneration planning. The first is the award itself and the second is the income distributions on the shares throughout ownership.

While the award itself is somewhat outside the scope of this article, the employee will often be subject to income tax (and PAYE/NIC where the shares are readily convertible assets) based on the market value at the date of issue less any amounts paid by the employee.

What is the market value?

Generally, discounts may be applied to the value of the shares on the basis that the employee is likely to be a minority shareholder. If the shares carry a right to capital and voting, clearly the market value will be higher than in a case where the shares only hold income rights.

For dividend only shares that do not carry an entitlement to a fixed dividend, it may be possible to legitimately argue they hold nothing more than a ‘hope’ value of the payment of future dividends. After all, a dividend will be at the discretion of the directors, it relies on the company generating profits and therefore having sufficient reserves.

Where there is a verbal or written agreement to pay a certain minimum dividend each year (eg as a salary sacrifice), it would be reasonable to value those shares at the net present value of the future dividend payments.

While each case would need to be considered on its merits, if the company has previously been in a situation of making a loss or having negative reserves, this may be useful evidence in assessing whether there is an entitlement to a minimum level of payment, eg during the time of insufficient reserves, did the employee suffer lower income without being compensated either via bonus or later increased dividends?

Rights attaching to the shares

Moving to the question of whether a dividend paid on those shares is genuinely a dividend or should be treated as earnings (incurring PAYE/NIC) for services performed, the leading case on the matter is CRC v PA Holdings Ltd [2012] STC 582.

In contrast to the more generic cases an adviser is likely to encounter, the facts in PA Holdings were somewhat more complex as the arrangement was designed to make distributions to employees which were subject to dividend tax rates in their hands but that also provided a corporation tax deduction for the company.

In reaching their conclusions the courts did acknowledge that there are circumstances in which employees may receive dividends where the source of that income is the shares, rather than the employment.

However, whether the distribution is being paid genuinely as a return on the capital value of the shares or as a receipt for services will depend on the facts of the case.

In its manual, ERSM60030, HMRC uses an example entitled ‘alphabet soup’ whereby employees each hold a separate class of dividend only shares to enable the company to pay different dividends to each employee.

In this case, HMRC considers the dividends to be a cash bonus and would seek to apply Chapter 3B ‘Securities with artificially enhanced market value’, on the basis that ‘each time a dividend is voted the value of the share will rise and each time the dividend is paid, the value will fall again’. The accumulated rises for the year will be artificial increases in value of the shares to which PAYE and NIC applies.

In practice, this example is more likely to apply where there are a large number of share classes enabling the company flexibility to pay many employees differing amounts, hence the term ‘alphabet soup’. The extent to which HMRC would seek to apply the provisions of Chapter 3B in practice is perhaps less of a concern. Nevertheless, it is an important factor to bear in mind.

However, ITEPA 2003, s 446K(1) applies ‘where the market value of employment-related securities is increased by things done otherwise than for genuine commercial purposes’.

Thus, a genuine commercial issue of shares and dividend payments should not be caught by Chapter 3B.

Given a dividend is a return on the capital value of the shares, it stands to reason that the commerciality of the payment will be more easily defendable where the shares held by the employee also carry a right to capital and/or votes. This is subject again to the concept of ‘thin’ shares where the employee’s capital and/or voting rights may be effectively ‘swamped’ by the number of shares in issue.

In the example where there is an agreed fixed dividend, eg due to a salary sacrifice arrangement, and income tax is paid on the net present value of those dividends at the date of the award, the future payments should therefore be considered a return on this capital investment and therefore retain their dividend nature.

In other, more contentious cases, it will be necessary to consider all factors to determine the level of risk of a successful challenge by HMRC.

Factors include:

The proportion of capital and voting rights attaching to the shares.

Whether there were sufficient distributable reserves to pay a theoretical dividend on all shares in issue at the same rate.

Any verbal or written agreements as to the future payment of dividends.

Any salary sacrifice arrangements (whether a salary is reduced or a regular bonus payment now becomes paid as a dividend).

Number of employees benefiting from the scheme and their seniority within the company.

Value of the shares initially awarded.

The market rate of the individual’s salary.

See Example 2.

Reporting requirements

Concerning the issue of shares within the ERS legislation, ITEPA 2003, s 421K requires such shares to be reported by 6 July following the end of the tax year in question.

This is not limited to situations where a tax liability arises, thus, any new issue of shares caught by the legislation, even where full market value is considered to be paid remains a reportable event in accordance with s 421K(3)(a).

Notable exceptions to the ERS legislation are where the ‘domestic, family or personal relationships’ exemption applies under s 421B(3) or where the employee-controlled conditions within s 421H apply.

Where dividend waivers are used, such as in the case of Donovan (TC3188) HMRC was entitled to raise discovery assessments on the basis that they could not have reasonably known dividend waivers were in force. This would suggest a white space note outlining further information may be prudent to prevent HMRC from being able to raise a discovery assessment in such cases.

Nick Wright

This email address is being protected from spambots. You need JavaScript enabled to view it.

07891 203889

Published in Taxation on 19th July 2022, written by Nick Wright.

https://www.taxation.co.uk/articles/use-of-alphabet-shares-in-trading-companies